omaha nebraska sales tax rate 2020

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. You can print a 7 sales tax table here.

Sales Taxes In The United States Wikipedia

The minimum combined 2022 sales tax rate for Omaha Nebraska is.

. This is the total of state county and city sales tax rates. Counties and cities can charge an. Registration fee for farm plated truck and truck tractors is based upon the gross vehicle.

2020 rates included for use while preparing your income tax deduction. Here are rates for cities around Omaha. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Omaha has parts of it located within Douglas County. The minimum combined 2022 sales tax rate. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

The minimum combined 2022 sales tax rate for omaha nebraska is. The sales tax rate in Omaha is 7. The average cumulative sales tax rate in Omaha Nebraska is 686.

The Nebraska state sales and use tax rate is 55 055. Federal excise tax rates on beer wine and liquor are as follows. Omaha NE Copperfields Homes for Sale from.

The Ord Sales Tax is collected by the. Groceries are exempt from the Nebraska sales tax. 107 - 340 per gallon or 021 - 067 per 750ml bottle.

Sale tax rates vary from city to city. Omaha Nebraska Sales Tax Rate 2020. Notification to permitholders of changes in local sales and use tax rates effective october 1 2022 updated 06032022 effective.

Sales Tax Calculator. 1800 per 31-gallon barrel or 005 per 12-oz can. The latest sales tax rate for Omaha NE.

Nebraska Income Tax Rate 2020 - 2021. The december 2020 total local sales tax rate was also 7000. 2020 rates included for use while preparing your income tax deduction.

This rate includes any state county city and local sales taxes. This includes the rates on the state county city and special levels. The latest sales tax rates for cities in Nebraska NE state.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. What is the sales tax rate in Omaha Nebraska. There is no applicable county tax or special tax.

County and city taxes. The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax.

Sales Taxes In The United States Wikipedia

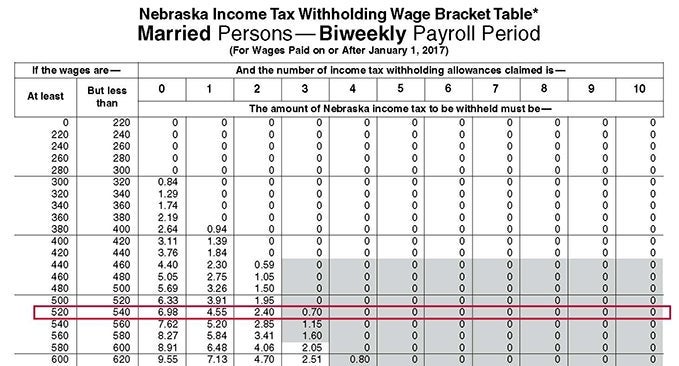

Income Tax Withholding Faqs Nebraska Department Of Revenue

Omaha Property Taxes Explained 2022

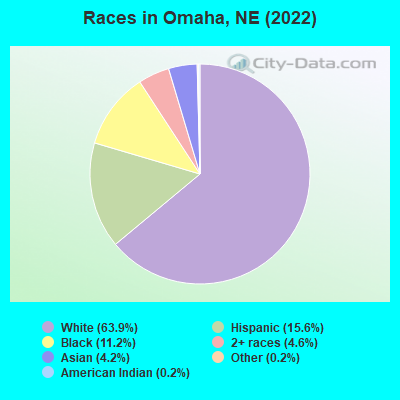

Omaha Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

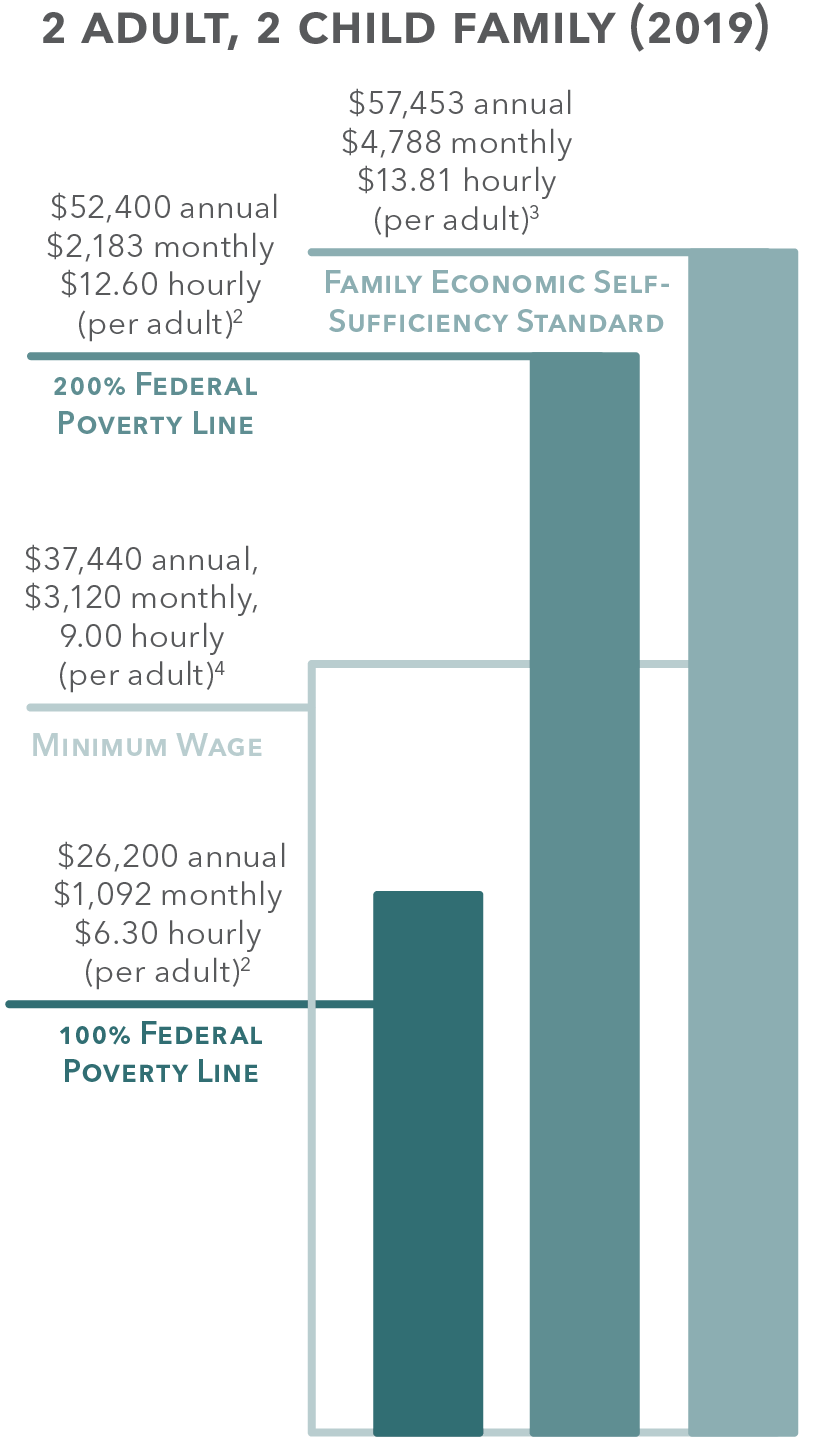

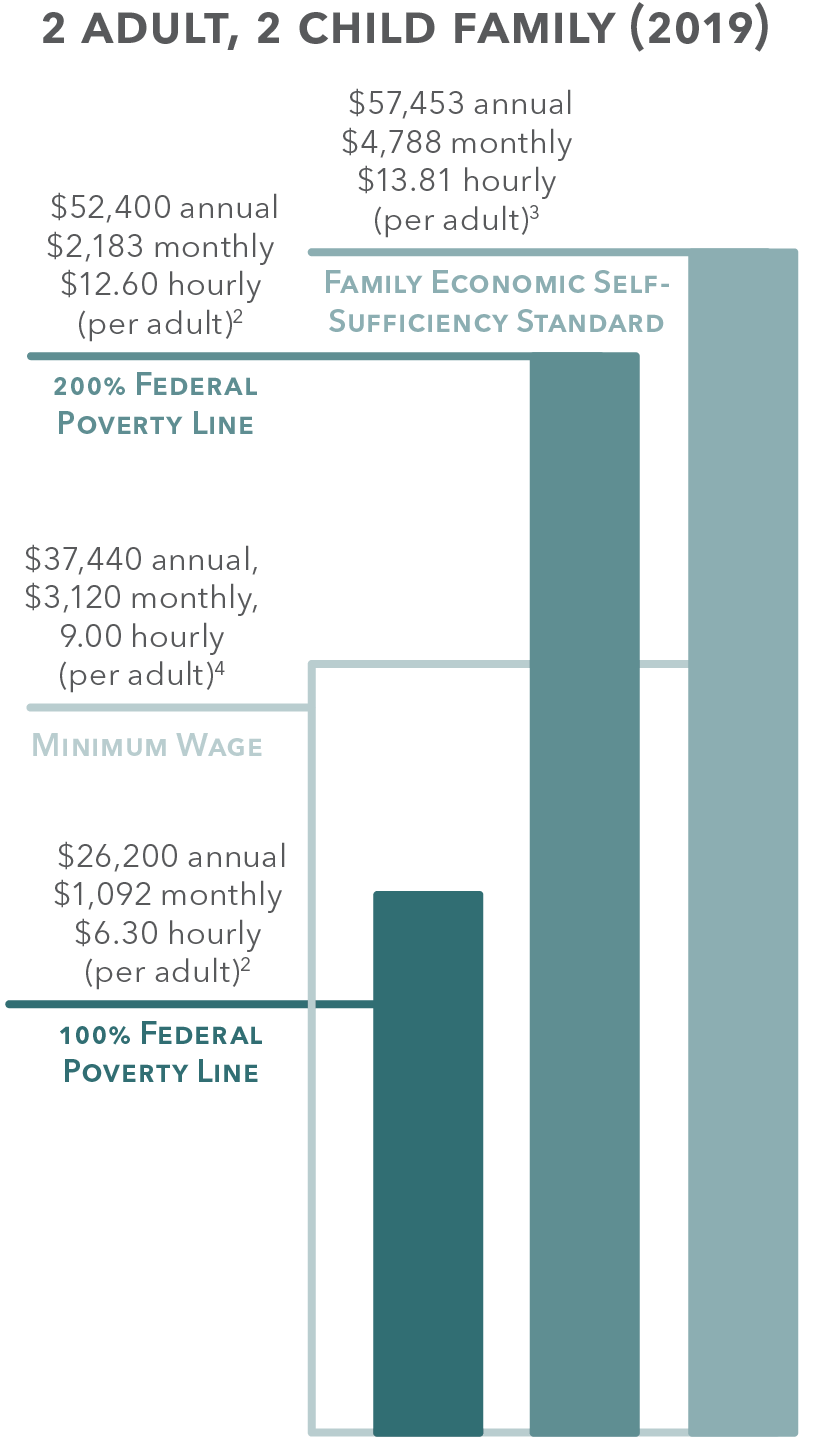

Economic Stability 2020 Kids Count Nebraska

Cell Phone Tax Wireless Taxes Fees Tax Foundation

State Tax Rates Comparison Property Sales Income Social Security Tax

Report Stock Sales On Taxes Easily How To Report Capital Gains Youtube

Historical Nebraska Tax Policy Information Ballotpedia

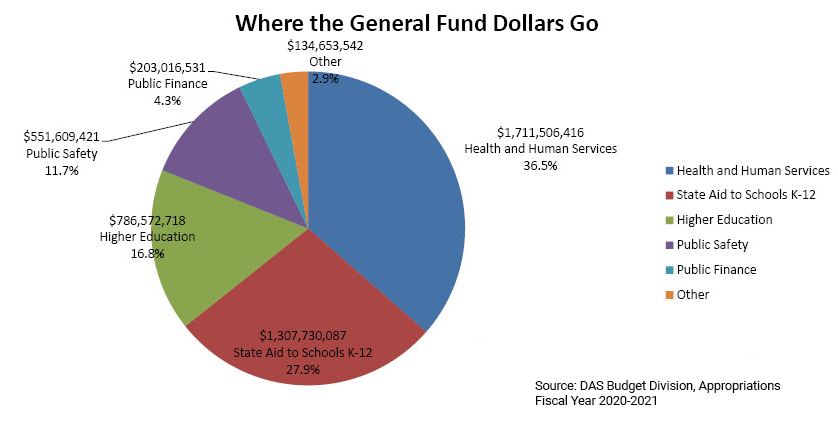

General Fund Receipts Nebraska Department Of Revenue

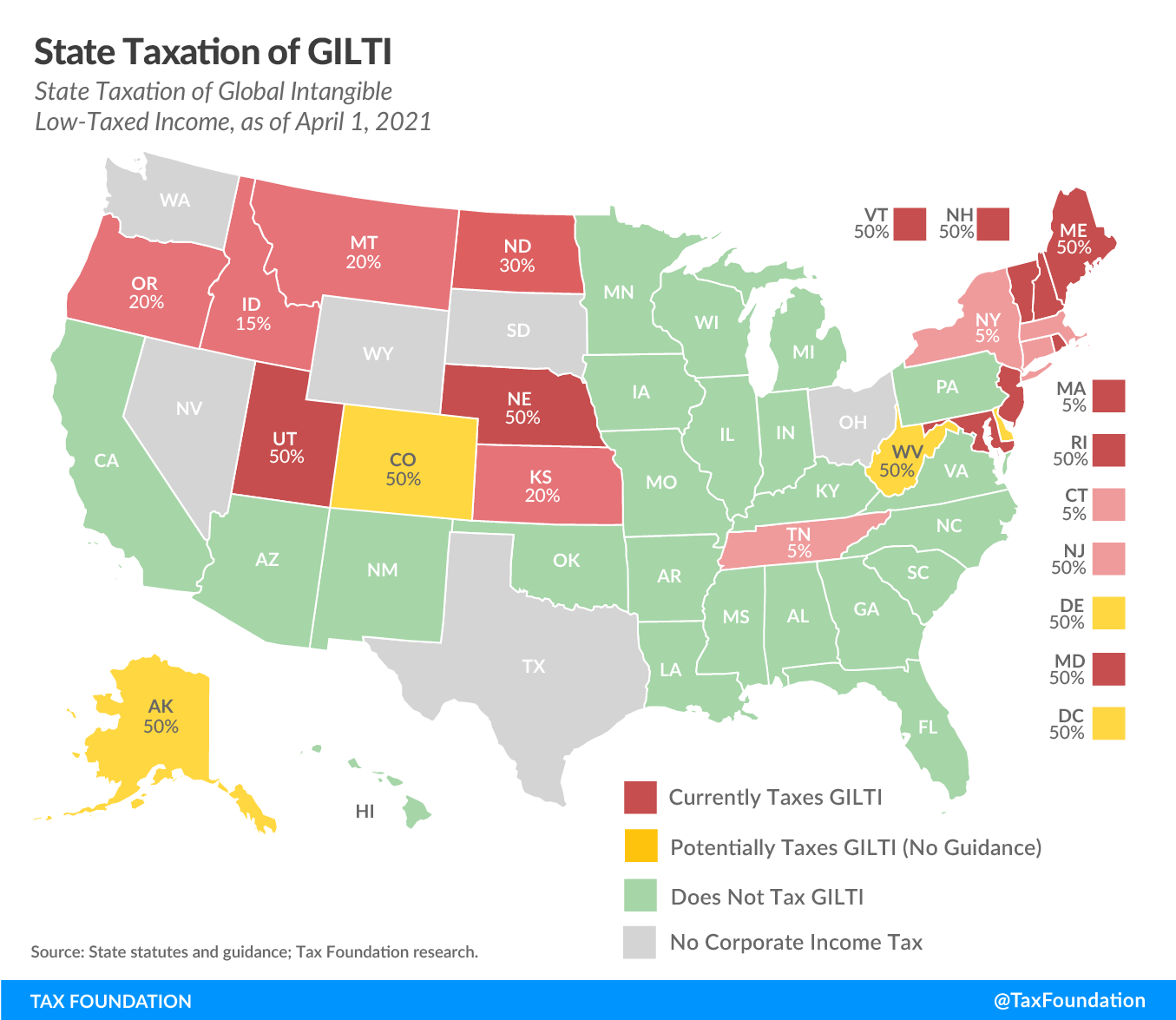

Nebraska Corporate Tax Bill Gilti And Corporate Rate Reduction

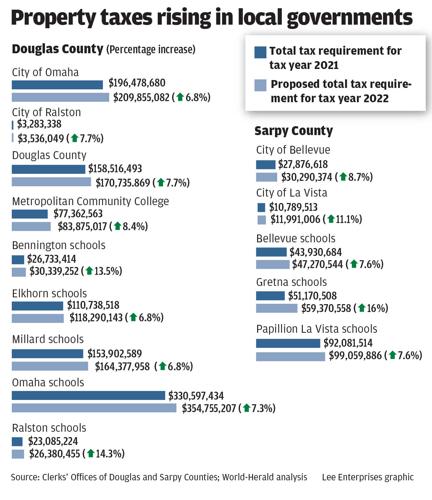

Local Governments Must Show Their Math To Taxpayers At Public Hearings Wednesday Local News Omaha Com